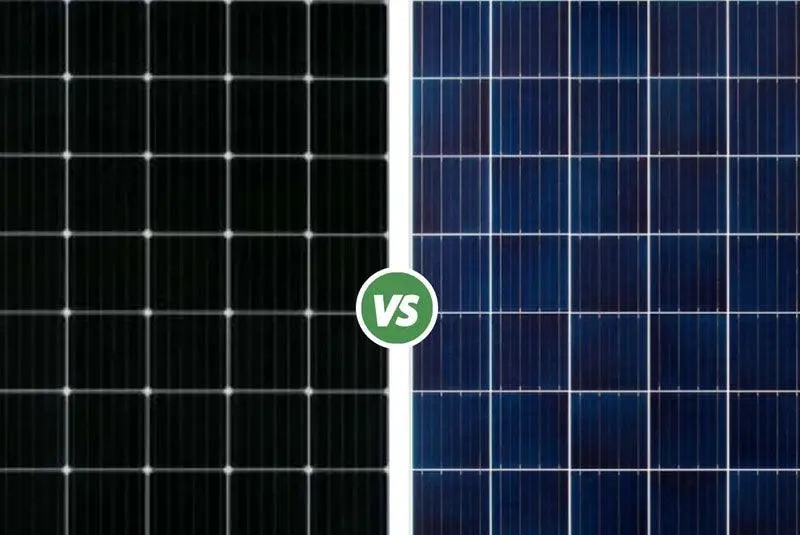

Monocrystalline vs. Polycrystalline Solar Panels Pros and Cons Compared

Monocrystalline silicon efficiency is as high as 15-22%, suitable for users with limited space and a pursuit of high power generation;

Polycrystalline silicon efficiency is about 13-17%, winning on cost-effectiveness.

If the budget is sufficient, choose monocrystalline; if looking for a bargain, choose polycrystalline. Both have a durable lifespan of over 25 years.

Appearance

Color Depth

Monocrystalline silicon modules exhibit extremely high absorption rates in the 380nm to 780nm visible light band, and their deep black surface can reduce light reflectivity to below 2%.

Due to the disordered crystal arrangement, the surface of polycrystalline silicon cells reflects a distinct blue luster under light, with reflectivity typically fluctuating between 5% and 8%.

During production, monocrystalline silicon wafers need to undergo texturing in an 80°C potassium hydroxide solution to form pyramid-like microscopic structures with a height of 3 to 5 microns. This structure allows light to undergo 2 to 3 secondary reflection absorptions on the cell surface.

In contrast, polycrystalline silicon uses an acidic etching process, forming pits with a depth of only 1 to 2 microns, resulting in a visual brightness about 15% higher than monocrystalline under standard 1,000 W/㎡ light intensity.

In the color difference control standards for modules, the color deviation ΔE value of monocrystalline cells is usually strictly limited to within 3, ensuring that an array composed of 72 or 60 cells achieves over 98% visual consistency.

Because polycrystalline modules contain crystal grains with different orientations, a single cell can have 5 to 10 blue blocks of varying shades, which leads to a roughly 12% visual mottling effect when observing a 10 kW rooftop power station from a distance.

Look at the Shape

During production, monocrystalline silicon cells are limited by cylindrical silicon ingots with a diameter of 200 mm to 300 mm. After slicing, they form four rounded corners with a radius of 10 mm to 15 mm.

When these cells with rounded corners are arranged on a 1.7-square-meter module surface, the intersections of the rounded corners expose about 1.5% to 2.2% of the white backsheet area, forming iconic white diamond-shaped gaps.

Polycrystalline silicon wafers are cut from cubic silicon ingots with a side length of 1.2 meters and a weight of up to 1000 kg. Each 156 mm or 182 mm wafer is a 90-degree right angle.

· M10 Specification Parameters: For 182 mm x 182 mm monocrystalline silicon wafers, when encapsulated into 550 W modules, the cell spacing is precisely controlled at around 0.5 mm.

· G12 Specification Parameters: Large-sized 210mm cells make the total module area reach 2.58 square meters, with a single unit weight typically between 28 kg and 32 kg.

· Space Utilization: The surface coverage of the polycrystalline right-angle design reaches over 99%. While the monocrystalline rounded corner design has an effective light-receiving area loss of about 0.8% for the same size, this is completely offset by its 4% higher conversion efficiency.

Crystal Texture

Observing the surface of a monocrystalline silicon wafer with the naked eye, basically no grain boundary textures can be seen, and its atomic dislocation density within a 1 cm range is lower than 1000 per c㎡.

The surface of a polycrystalline silicon wafer is covered with crystal particles similar to crushed ice flowers, with each particle's diameter ranging from 0.5 mm to 10 mm. The impurity concentration at the grain boundaries is 20 to 50 times higher than that of monocrystalline silicon.

These grain boundaries not only affect aesthetic appeal but also lead to a 0.3% to 0.6% recombination loss during electron transport.

Observed through a magnifying glass of over 50x, the distribution density of the textured pyramids on a monocrystalline silicon wafer reaches over 1 million per square millimeter.

The polycrystalline silicon surface features pits of varying depths, which produce about 3% diffuse reflection under 45-degree oblique lighting, leading to a visual flicker frequency about 25% higher than monocrystalline at 8 AM or 5 PM.

The high-purity silicon material of monocrystalline silicon (purity 99.9999999%) ensures that after 15 years of operation, the appearance can still maintain over 95% of its original color state.

Count the Busbars

Modern modules typically use MBB (Multi-Busbar) technology, with 9 to 12 round ribbons distributed on 182 mm cells. These ribbons usually have a diameter between 0.25 mm and 0.35 mm.

Because monocrystalline modules often use "All Black" packaging with black backsheets and black frames, the ribbon surfaces are coated with a black layer with reflectivity below 5%, giving the entire panel a pure black glassy texture when viewed from 10 meters away.

· Ribbon Spacing: The ribbon spacing under a 10-busbar design is about 18 mm, shortening the current transmission path by 1.5 mm and reducing internal resistance loss by 0.2% .

· Shading: The fine busbar design increases the effective light-receiving area of the cell by 0.4% to 0.6% .

· Visual Invisibility: For monocrystalline modules using triple-cut or shingled processes, the cell overlap area is only 1mm to 2mm, almost eliminating the visual interference of 10mm-wide busbars found in traditional modules.

Measure the Frame

The periphery of the module is wrapped in a 6063-T5 grade aluminum alloy frame, with thicknesses usually divided into three specifications: 30mm, 35mm, and 40mm.

The anodic oxide film thickness on the frame surface must reach over 15 microns to ensure that in a 25-year exposure environment, the annual reduction of the oxide layer does not exceed 0.3 microns.

To pursue high-end market aesthetics, monocrystalline modules often choose a 35mm thick matte black oxidized frame, which has a salt spray test tolerance exceeding 2000 hours.

The front of the module is covered with 3.2 mm thick ultra-white patterned tempered glass, which has a light transmittance between 91.5% and 94%.

The pyramid-shaped embossing depth on the glass surface is controlled at 20 to 40 microns, effectively reducing the reflection loss of the module by about 1.2% under 60-degree high-angle incident light.

A 72-cell monocrystalline module weighs about 23.5 kg, with glass accounting for over 65% and the frame about 10%. These physical parameters together provide the appearance strength guarantee for the power station to withstand 5400 Pa of physical pressure for 25 years.

Space Efficiency

How Much Land is Occupied

Under Standard Test Conditions (STC, 1000 W/㎡), the power output per unit area of monocrystalline silicon modules is typically maintained between 210 W and 230 W. In contrast, due to their lower conversion efficiency of 16% to 18%, the power per unit area of polycrystalline silicon modules is only 150 W to 170 W.

This means that on the same 100-square-meter roof, installing monocrystalline modules with 22% efficiency can achieve an installed capacity of 22 kW, while installing 17% efficiency polycrystalline modules only reaches 17 kW, a total capacity gap as high as 29.4%.

For a family with an annual electricity consumption of 12,000 kWh, a monocrystalline system requires only 45 to 50 square meters of installation space to cover 100% of the demand, while a polycrystalline system needs 65 to 75 square meters, occupying nearly 40% more roof resources.

Data Reference: On a limited 20-square-meter balcony or small roof, 10 pieces of 450W monocrystalline modules can be arranged for a total power of 4.5 kW; if replaced with 330W polycrystalline modules, only 8 to 9 pieces can be arranged in the same area, with total power shrinking to around 2.8 kW, and daily power generation income decreasing by 6.8 kWh.

In commercial roof leasing scenarios, if the annual rent per square meter is 50 yuan, the annual rent cost per kilowatt for a monocrystalline system is about 225 yuan. For a polycrystalline system, because the land area increases by 30%, the annual rent cost per kilowatt will climb to over 315 yuan.

Over a 25-year power station operation cycle, for rent alone, a polycrystalline system will cost 2,250 yuan more per kilowatt than a monocrystalline one, which is almost equivalent to the initial procurement cost of the entire module set.

Compare Load-bearing Capacity

Each 2.2-square-meter monocrystalline module weighs about 24 kg, equivalent to a static load of 10.9 kg per square meter. When the total system power reaches 10 kW, the total weight added to the roof by the monocrystalline solution is about 530 kg.

A polycrystalline system of the same power requires more panels, so the total weight will jump to between 720 kg and 750 kg, increasing the pressure on the eaves support structure by 35.8%.

When facing 2400 Pa wind pressure and 5400 Pa snow pressure tests, the monocrystalline system has about 15 square meters less wind-facing area than the polycrystalline one, reducing the horizontal pull on the bracket system by a deformation of 300 nm to 500 nm.

Parameter Comparison: The roof load per kilowatt for a monocrystalline system is about 53 kg, while for a polycrystalline system, it is as high as 75 kg. On color steel tile roofs with a load-bearing limit of 15 kg/㎡, the polycrystalline solution often cannot be fully laid out due to exceeding the 20% safety margin limit.

During the installation process, the high power density of monocrystalline modules reduces the number of fixed clamps by 18% and the length of guide rails by 15%.

Taking a 5 kW system as an example, the monocrystalline solution requires only 12 to 14 hooks, while the polycrystalline solution requires 18 to 20 drilling positions. This not only increases construction time by 30% but also raises the probability of potential roof leakage risk from 0.1% to about 0.25%.

Calculate Auxiliary Material Costs

The improvement in space utilization directly compresses the procurement budget for the Balance of System (BOS).

In 100 kW industrial and commercial projects, using high-efficiency monocrystalline modules can reduce the usage of DC cables (4 mm² or 6 mm²) from 2,500 meters to 1,900 meters, saving about 3,500 yuan in material costs on cables alone.

Since the number of modules is reduced by 22%, the specifications of the matching combiner boxes and circuit breakers can also be lowered accordingly. The internal resistance loss of the overall electrical system is reduced by 0.3% to 0.5%, which translates into an additional annual power generation income of about 1,500 kWh.

Cost Analysis: The comprehensive cost of auxiliary materials and construction per watt for a monocrystalline system is about 0.45 yuan, while for a polycrystalline system, it usually rises to 0.58 yuan due to scattered arrays and longer brackets, which offsets the 15% price advantage of polycrystalline modules themselves.

With rising labor costs, installing 50 monocrystalline modules usually requires 3 workers to cooperate for 6 hours. Installing 70 polycrystalline modules to reach the same power takes 8.5 hours.

Calculated at a labor fee of 150 yuan per person per hour, the monocrystalline solution can directly save 1,125 yuan during the construction phase.

Meanwhile, because the monocrystalline array is more compact, the inverter can be installed within 5 meters of the array, keeping line loss below 0.8%, while the polycrystalline array may be forced to extend beyond 15 meters, causing the line loss rate to climb above 1.5%.

Look at the Long-term Account

During the 25-year operation period, the linear degradation rate of monocrystalline modules is typically controlled between 0.4% and 0.55% per year, while for polycrystalline modules, it is often between 0.65% and 0.8% due to grain boundary defects.

This means that by the 20th year, the same 1 square meter of monocrystalline panel can still produce 190 W of electricity, while the polycrystalline panel may have dropped below 130 W. The space output ratio gap between the two widens from an initial 30% to over 46%.

Income Forecast: Calculated at an electricity price of 0.6 yuan/kWh, the cumulative electricity revenue created per square meter by a monocrystalline system over 25 years is about 2,800 yuan, while for a polycrystalline system, it is only 1,950 yuan. The difference in land output value per unit area is as high as 850 yuan.

For an owner with 30 square meters of idle roof, the Internal Rate of Return (IRR) for choosing a monocrystalline solution is typically between 11.5% and 13%, with a payback period of about 5.2 years.

If a polycrystalline solution is chosen, although the initial total investment is reduced by 800 to 1,200 yuan, its IRR will drop to around 8.5% because the total power capacity is 1.5 kW lower, and the payback period will be extended to 6.8 years.

This space-based premium effect makes the Levelized Cost of Electricity (LCOE) of monocrystalline solutions 0.04 to 0.06 yuan lower than polycrystalline solutions in land-scarce urban environments.

Heat Tolerance

Are They Afraid of Heat

The power output of solar panels is inversely proportional to temperature. Standard Test Conditions (STC) are set at 25 degrees Celsius, but the measured temperature of cells on summer roofs often soars to 65 to 75 degrees Celsius.

The power temperature coefficient of monocrystalline silicon modules is usually between -0.35%/℃ and -0.38%/℃, while polycrystalline silicon modules are generally in the range of -0.40%/℃ to -0.45%/℃.

This means for every 1 degree Celsius increase in temperature, the power loss of monocrystalline is about 0.05% less than that of polycrystalline.

When the ambient temperature reaches 35 degrees Celsius and the module heats up to 70 degrees Celsius, the 45-degree temperature difference will cause a 15.75% instantaneous power drop for the monocrystalline system, while the drop for the polycrystalline system is as high as 18.9%.

The output power gap between the two at the peak heat moment reaches 3.15%.

Under 1,000 W/㎡ light intensity, a monocrystalline module with a rated power of 550 W can still output about 448 W of electricity at a high temperature of 75 degrees Celsius.

In comparison, a 550W polycrystalline module of the same specification can only output about 431W under the same heat, with a power generation difference of 17W per panel.

For a 100 kW industrial and commercial power station, this performance difference based on temperature coefficient will cause the system to produce 3.1 kWh less electricity per hour during the high-temperature period from 11 AM to 2 PM.

Calculated over a 90-day summer peak heat period, the cumulative electricity fee loss will exceed 500 yuan.

Temperature Index Parameter | Monocrystalline Module (P-type) | Polycrystalline Module (P-type) | Performance Gap |

Power Temp Coefficient (Pmax) | -0.37%/℃ | -0.43%/℃ | 16.2% Stability Improvement |

Open-circuit Voltage Temp Coeff (Voc) | -0.28%/℃ | -0.32%/℃ | 14.3% Voltage Drop Optimization |

Operating Temp (NOCT) | 45℃ ± 2℃ | 46℃ ± 3℃ | Mono has a higher heat dissipation upper limit |

Power Retention Rate at 75℃ | 81.5% | 78.5% | 3% Absolute Income Difference |

Calculate Power Generation

In tropical or subtropical regions where the average temperature exceeds 30 degrees Celsius, monocrystalline modules, with their lower temperature sensitivity, typically have an average annual power generation per watt that is 3.5% to 5.2% higher than polycrystalline modules.

Taking a region with an annual sunshine duration of 2000 hours as an example, a 1 kW monocrystalline system can produce about 1450 kWh of electricity per year, while a polycrystalline system often produces only about 1,380 kWh due to heat loss.

This 70-kWh difference will cumulatively form a 1750-kWh power generation gap over a 25-year lifespan.

In electrical design, rising temperature leads to falling voltage. The Voc (open-circuit voltage) temperature coefficient of monocrystalline modules is typically -0.27%/℃, which is more robust than the -0.33%/℃ of polycrystalline.

In a 70-degree Celsius environment, the voltage drop of a monocrystalline string is about 12.1%, while that of a polycrystalline string reaches 14.8%.

This causes the inverter to be closer to the lower limit of the Maximum Power Point Tracking (MPPT) voltage at noon, resulting in an additional 0.2% to 0.4% conversion efficiency loss.

Earnings Data Quote: If calculated at an industrial and commercial electricity price of 0.8 yuan/kWh, a monocrystalline system can create 56 yuan more revenue per kilowatt per year due to its heat resistance advantage. For a 500 kW rooftop project, this is equivalent to an extra net increase of 28,000 yuan in cash flow per year, enough to cover 20% of the system's annual operation and maintenance costs.

Durability of Modules

Monocrystalline silicon has a single crystal structure, and the covalent bond binding energy between its atoms is more consistent. In the Damp Heat 85 (DH85) test at 85 degrees Celsius and 85% humidity, the 1000-hour degradation rate of monocrystalline modules is usually controlled within 1.5%.

Because of the large number of grain boundaries inside polycrystalline silicon, high temperatures promote the migration of impurity ions at the boundaries, leading to a risk of Potential Induced Degradation (PID) that is 25% to 40% higher than that of monocrystalline.

The light transmittance of the EVA film used for module encapsulation drops by about 0.15% to 0.2% per year under long-term 70-degree Celsius operation.

Since polycrystalline modules require a larger light-receiving area to compensate for efficiency deficiencies, the area of backsheet material used is more than 18% greater than that of monocrystalline modules of the same power. This means, under the dual effect of UV and high temperature, the physical probability of backsheet cracking and yellowing in polycrystalline systems increases by 12%.

· Hot Spot Risk: When partial shading occurs, the breakdown voltage distribution of monocrystalline cells is more uniform, and the maximum hot spot temperature is usually limited to within 150 degrees Celsius. In contrast, due to crystal defects, the center temperature of hot spots in polycrystalline cells can exceed 180 degrees Celsius, increasing the probability of module burnout by 0.5% .

· Mechanical Stress: The expansion coefficient of silicon is 2.6x10⁻⁶/K, which differs from the 9x10⁻⁶/K of glass. The uniform structure of monocrystalline silicon shows an increase in micro-cracks of only 0.8% after 200 thermal cycles from -40℃ to 85℃, while the micro-crack risk for polycrystalline silicon is as high as 2.3% due to varying grain orientations.

Heat Dissipation Speed

Because monocrystalline modules have high conversion efficiency, the number of modules required to install the same 10 kW power is about 20% less than for polycrystalline modules, which means the heat dissipation gaps between panels can be designed wider.

In rooftop installations, maintaining a ventilation gap of 10 cm to 15 cm between the module backsheet and the roof surface can reduce the module operating temperature by 3 to 5 degrees Celsius.

For monocrystalline systems, this temperature drop can bring a power recovery of 1.1% to 1.9%;

For polycrystalline systems, although the recovery can reach 1.3% to 2.2%, because their coefficients are more sensitive, their larger coverage area often hinders the air flow rate.

Monocrystalline modules typically use 3.2 mm or 2.0 mm (double-glass) reinforced glass, which has a thermal conductivity of about 1.05 W/(m·K).

In extreme cases where light intensity reaches 1,100 W/㎡ at 12 noon, the back temperature of monocrystalline double-glass modules is usually about two degrees Celsius lower than that of single-glass polycrystalline modules.

This 2-degree Celsius temperature difference directly translates into a 0.7% system efficiency advantage.

Over a 25-year operation period, the linear degradation curve of monocrystalline modules is flatter than that of polycrystalline modules.

By the 25th year, the output power of monocrystalline modules can typically be maintained at over 84.8% of the initial value, while the power retention rate of polycrystalline modules, affected by encapsulation aging caused by thermal stress, can often only be maintained between 80.2% and 81.5%.

This 4.6% end-of-life power gap makes the residual value assessment of monocrystalline assets 15% to 20% higher in the second-hand market or during recycling.